For the past 4 months I have been using a WealthSimple Crypto Credit as a replacement for my major Canadian bank credit card, and so far I have been really pleased with my experience. As an existing WealthSimple customer for the past 2-3 years this was a new service I began to use. In short, I have never experienced an issue using the card, it funds very quickly, and both the physical card and Mobile Wallet Card work very smoothly everywhere VISA is accepted.

My previous credit card, while having it for year, did not have the best rewards program as is was a basic card with no annual fees or anything like that. I used it for years and I would typically get around $250/year in rewards. Recently I started to look more closely at my monthly statement (in terms of cash in/out and rewards) and noticed something was off. With my original credit card the rewards program was 1% cashback on for most purchases at select types of retails locations (i.e. grocery, gasoline, etc….). What I found was that I was only receiving the 1% rewards on roughly 2/3rd of my purchases, so for example if I sent $3,000 on the card in a month I would roughly receive $20 in rewards. While this was not a bad reward rate, but I knew there were better options out there.

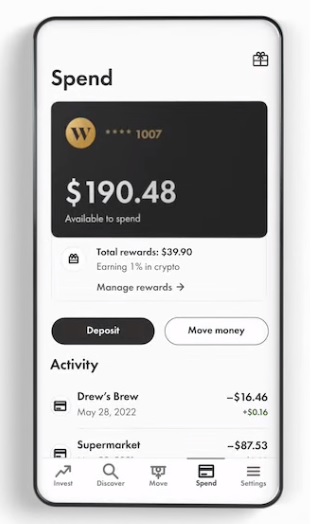

Throughout my search for a credit card replacement I found that WealthSimple offering a pre-paid Crypto Credit Card. As a current WealthSimple customer I already had my bank account setup, so adding the Crypto Credit Card was just a few clicks of a button. Once the Credit Card service was added to my account, I had access to my new credit card number so I could use it virtually (i.e. online purchases, or mobile wallet apps), with the physical card to be mailed out within 7-10 days. There is also the WealthSimple Cash Mobile App, that you can also use to see more details and settings about your credit card, including adding the card to your cell phone, changing rewards type and locking the card.

As this was pre-paid credit card service you need to pre-fund the account prior to spending. Funding is simple and is the same way you would fund a trading account, except you just click your “cash” account and the funds are available within 45 seconds to a minute literally. My bank account was already setup as I have other accounts with WealthSimple, but added a bank account can be easily be done within a few minutes. I was using this to primarily fund the card, yet I found that the limits on bank transfer was $250 over a 3-5 day period. This was getting annoying as I was often hitting these limits, and this also affected my spending dates and time, and how I would be paying. While looking through the other funding options support by WealthSimple, I noticed that Debit-Cards are also supported. Thinking this would be an excellent supplementary option for funding my Cash/Credit Card account, while reading the fine print it was noted that only VISA/MasterCard Debit cards are permitted, which my bank debit card was neither. My bank did offer this type of card as a Virtual Visa Debit as a separate card, and this was primarily intended for online purchases via Visa/MasterCard, yet directly debits a bank account. I signed up for one of these Virtual Visa Debit cards offered by my bank as I had other reasons to use that card on other sites, so this was just the kicker I needed to sign-up for one. Fast forward another 7-10 days I received the card in the mail, and easily added this as a funding option for the WealthSimple Crypto Credit Card.

Once you have the Credit Card setup, the next step is to set your rewards to one of the following 3 options:

- Add the rewards to the cash balance of your stock trading account

- Add the rewards to the cash balance of your crypto trading account

- Auto-purchase the cryptocurrency of your choice in your crypto trading account

Using the card is very simple as well. If I am making a large purchase, I typically plan funding the card ahead of time to ensure that the funds are available and I get the full rewards. Otherwise if I am just using the card for regular purchases I estimate what my bill will be, and add the funds via my cell phone when inline at the register. Over the past few months that I have been using this card I have never had an issue funding the card and is usually done within 45 seconds to a minute. There have a been a few times where the transfer did not work, but it always go through the second time.

Over the time that I have been using the card I always receive my rewards within a day or two of purchase, and have received the full 1% cash back on all my purchases. Overall I am completely happy with this card, and it has become the credit card I primarily use, and am working towards transferring my pre-authorized credit card purchases such as my cell phone to this card as well to ensure I get the most rewards for my spending. In addition, from a personal finance perspective, now that I have been primarily using a pre-paid credit card my original Canadian Bank Credit Card consistently has a very low balance.

WealthSimple Crypto Credit Card Review (5 out of 5):

If you are interested in signing up feel free to use my Referral Code to get rewarded with up to $3,000 in cash to trade stocks or crypto commission-free.

https://my.wealthsimple.com/app/public/trade-referral-signup?code=RZZLSW